Comprehensive Guide to Completing the TTB Application and Oregon Liquor Control Commission Licensing

Craft distilling is a growing industry, with $14 billion in total revenue (in 2018).

However, getting a new distillery started can be tricky. There are national, state, and local regulatory agencies that oversee the industry.

The Alcohol and Tobacco Tax and Trade Bureau (a bureau of the United States Department of Treasury) regulates and registers ethanol production facilities.

Below you will find a helpful breakdown of application requirements and a handy checklist of steps you should be aware of ...

Prefer Audio?

You can listen to PACE's chat about this helpful TTB guide.

Code of Federal Regulations (CFR)

The "Code of Federal Regulations (CFR) Title 27: Alcohol, Tobacco and Firearms Part 19: Distilled Spirits Plants" specifies the regulations that apply to the licensing of distilled spirits plants (DSP).

Oregon Liquor Control Commission (OLCC)

The Oregon Liquor Control Commission (OLCC) regulates statewide production, distribution, and commerce related to distilled spirits.

The information in this guide will help you complete the OLCC application as well as the TTB application, so it can be useful for Oregon-based distillers, as well as prospective distillers in other states.

BUSINESS REGISTRATION

Before beginning the TTB and OLCC applications for a new distilled spirits plant, you need to register your company and its trade name with the Oregon Secretary of State’s office, which has to approve your company to conduct business.

In Oregon, registration can be done at the Oregon Secretary of State website at:

http://sos.oregon.gov/business/Pages/default.aspx

Six Steps of Distilling Business Structure Application Requirements

One challenge related to setting up a new distillery plant is registering your business and getting the proper permits. This guide aims to clarify that process and layout the steps you need to take.

Here are the six steps you need to take in order to register your business and obtain the proper permits.

1. Business Registration

2. Pre-Application Logistics

(Can be completed simultaneously)

- Obtain employer identification number

- Supplier-retailer relations affirmation

- Obtain a physical location and have equipment ordered

- Designation of responsible person for setting standards and policy for alcohol service

- Complete TTB application for owner/officer information

3. Application Process

(Can be completed simultaneously)

- TTB new distilled spirit plant application

- OLCC distillery licensing application

4. Local Government Approval

5. Spirit Production

6. Labeling and Formula Applications

Rules for Registering Your Distillery Name

When registering your company name, keep in mind that the TTB has certain rules in place regarding trade names. To meet federal requirements, your company name:

- Must not use prohibited geographical names or references, refer to famous landmarks or individuals, or use other language that could imply approval or endorsement by some level of government.

- Must not imply any health or physical benefits or effects, and does not refer to the strength of the product.

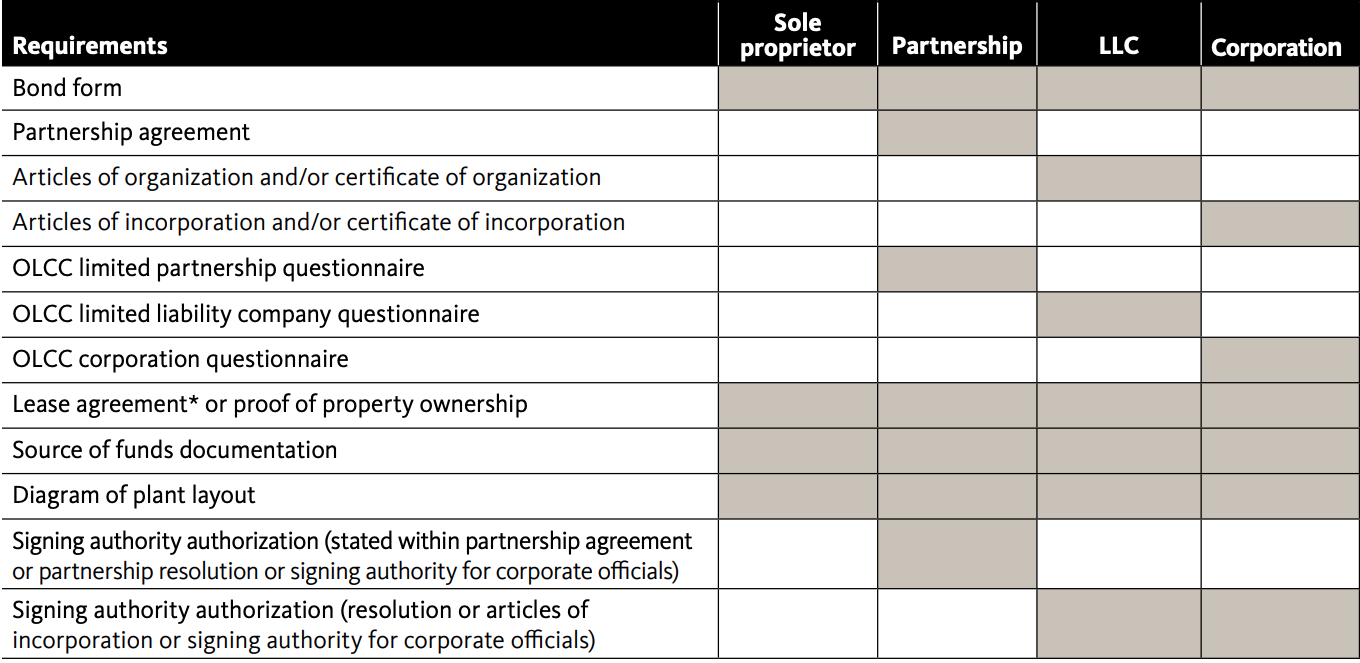

Spirits Business Structure Application Requirements

Shaded boxes indicate required application items for each type of business structure.

* Lease agreement must authorize distilling or other DSP operations.

* Must not contain “Inc.”, “Incorporated”, “Corporation”, “LLC”, or any similar wording (unless the state requires such wording), suggesting it is the legal name of the company (however, the word “Limited” is allowed).

* Must not represent the proprietor as a distiller, rectifier, wine producer, brewer, or bottler of distilled spirits, wine, or beer, when they

are not.

* Must not contain obscene or indecent wording or language.

Distilled Spirits Business Structure

Your distilled spirits plant can be structured as a sole proprietor, partnership, LLC, or corporation. Each business structure has different legal requirements, outlined broadly in the Business Structure breakdown above.

For more specific information see “Required Documents for TTB New Distilled Spirits Plant Application.”

FIVE TASKS BEFORE STARTING BOTH APPLICATIONS

After you have registered the business with the Oregon Secretary of State’s office, there are five tasks you need to complete before starting your TTB and OLCC applications.

- Getting an employee identification number.

- Completing a supplier-retailer relations affirmation.

- Obtaining a suitable location and equipment.

- Designating a responsible person for setting standards and policies for alcohol servers.

- Completing the TTB application for owner/officer information.

You can complete these tasks simultaneously.

1. Employee Identification Number for Distillery

After the company has been established, you can get an employer identification number (EIN) from the Internal Revenue Service (IRS). The IRS issues EINs for tax administration purposes; EINs are not intended for use with other activities (e.g., tax lien auctions or sales,

lotteries, etc.).

To obtain an EIN, fill out:

- Department of Treasury Internal Revenue Service Form SS-4.

- Apply online at - https://www.irs.gov/businesses/small-businesses-self-employed/apply-for-an-employer-identification-number-ein-online.

2. OLCC Supplier-Retailer Relations Affirmation

This is a statement that each OLCC liquor license applicant has read the supplier-retailer relations guidelines. The affirmation requires the registered trade name of the business, address of the business, and the name and signature of each liquor license applicant.

These guidelines and the affirmation can be found on the OLCC website at:

- https://www.oregon.gov/olcc/docs/publications/supplierretailerguidelines.pdf

- https://www.oregon.gov/olcc/docs/publications/SupplierRetailerAffirmation.pdf

3. Distillation Site and Equipment

The application for a new distilled spirits plant requires that you complete on-site construction and order equipment. On the application, you need to supply specific information about the equipment.

Be sure to examine 27 CFR §19.52 (which outlines restrictions on distilled spirits plant locations) and 27 CFR §19.75 (which states what information is needed for major equipment). The TTB distilled spirits plant application also requires a physical description and diagram of the site. For more specific information see “Required Documents for TTB New Distilled Spirits Plant Application.”

4. Designation of a person responsible for setting standards and policies for alcohol servers

If you want to offer on-site tasting, an individual must be designated to set standards and policies for alcohol servers. This individual and all alcohol servers must have a service permit. This can be achieved by taking an OLCC-approved alcohol server education class, filling out the service permit application, and having it signed by an OLCC employee, alcohol server education course instructor, or manager designated to set standards and policies for alcohol servers.

Once this is complete, mail the Service Permit Application with appropriate payment (indicated on the application) to the OLCC at:

OLCC Permits

PO Box 22297,

Milwaukie OR 97269-2297

You can use a copy of the application as a 45-day temporary permit.

The Service Permit Application and a list of OLCC approved alcohol server education classes can be found at:

- https://www.oregon.gov/olcc/docs/service_permits_and_server_ed/Online_Liquor_Licensing_System_User_Guide.pdf

- https://www.oregon.gov/olcc/pages/portalservicepermits.aspx

An individual in your organization should obtain a service permit or submit the service permit application(s) before you complete the limited partnership, limited liability company, or corporation questionnaire.

5. Application for Officer/Owner Information

You can find the Officer/Owner Information Application on the TTB online permits system. The TTB strongly recommends using the online electronic system instead of paper forms. This system is used for the Officer/Owner Information Application and the Application for New Distilled Spirits Plant.

- You can register for the system at: https://www.ttb.gov/ponl/permits-online.shtml.

- Once registered, you can access the Application for Officer/Owner Information. A short tutorial on online permits can be found at: https://www.ttb.gov/ponl/permits_online-tutorials.shtml.

The Officer/Owner Information Application must be completed for every stockholder with 10% or more holding in the company, sole proprietor, partner, officer, director, trustee, member and/or managing member, as well as any company or trust holding ownership.

Checklist for Completing the Officer/Owner Information Application

❏ Commercial credit reporting agency

❏ Residence information

❏ Employment history

❏ Bank reference

❏ Character-business references

You will need to gather a range of information to complete the Officer/Owner Information Application.

It can be helpful to have this information handy before beginning the online application process. The following is required information for each section of the application (in the order it appears on the TTB online system):

- Applicant name and Address.

- Name; position; home address; phone number; social security number; gender; birth date.

- Name; position; home address; phone number; social security number; gender; birth date.

- Applicant Information.

- Common name used; permit tracking number (if known); any other names used; birthplace; felony information; disapproval of application related to alcohol; amended permit or registration; commercial credit reporting agency name, address and rating details; physical description of applicant; IRS violations related to alcohol, tobacco, or firearms (ATF); citizenship status; if you have ever been connected with a federal permit for ATF-related information (permit number, address); declaration of employment related to ATF.

- Common name used; permit tracking number (if known); any other names used; birthplace; felony information; disapproval of application related to alcohol; amended permit or registration; commercial credit reporting agency name, address and rating details; physical description of applicant; IRS violations related to alcohol, tobacco, or firearms (ATF); citizenship status; if you have ever been connected with a federal permit for ATF-related information (permit number, address); declaration of employment related to ATF.

- Residence Information.

- Non-citizen or lived outside of the United States in last 10 years: 10 years of dates and addresses of each residence.

- U.S. citizens: 5 years of dates and addresses of each residence.

- Employment Information.

- Time frame of employment; name of employer; address of employer (includes self-employment)

- Time frame of employment; name of employer; address of employer (includes self-employment)

- Bank reference information (a minimum of one bank reference is required).

- Name of bank; name and title of individual providing reference; bank address and phone number of individual providing reference.

- Name of bank; name and title of individual providing reference; bank address and phone number of individual providing reference.

- Character-business references (a minimum of four character-business references are required).

- The references should be able to speak to your character and business responsibility; references cannot include relatives or employers previously listed in other areas of the application.

- The references should be able to speak to your character and business responsibility; references cannot include relatives or employers previously listed in other areas of the application.

- Declaration attesting to validity and truthfulness of the document.

After submitting a completed application, you will receive an officer/owner information tracking number.

TTB AND OLCC APPLICATION PROCESS

The TTB new distilled spirits plant and OLCC liquor licensing applications can be completed simultaneously. A wholesaler’s permit is not necessary unless you intend to sell spirits, beer, or wine you do not manufacture.

Checklist for documentation for the TTB New Distilled Spirit Plant Application

❏ Lease agreement or proof of property

❑ Source of funds

❏Diagram of plant or plan

❏ Organizational documents

❑ Meeting minutes (if applicable)

❏ Bond form (if applicable)

❏Signing authority form (if applicable)

❏Power of attorney (if applicable)

Required Documents for TTB New Distilled Spirits Plant Application

The TTB New Distilled Spirit Application can be downloaded; however, the TTB highly recommends that you complete the online version instead of submitting a paper copy.

The TTB distilled spirit plant permit application requires you to upload specific documents and forms. The process will go more smoothly if you fill out and collect the following items prior to starting the online application.

- Lease agreement or proof of property.

- The lease agreement or proof of property for your DSP production, storage, or processing facility. Lease agreement must authorize distilling or other DSP operations by the lessor.

- The lease agreement or proof of property for your DSP production, storage, or processing facility. Lease agreement must authorize distilling or other DSP operations by the lessor.

- Source of funds.

- Amount invested and source of funds must be provided for each stockholder with 10% or more holding in the company, sole proprietor, partner, officer, director, trustee, member and/or managing member, as well as any company or trust holding ownership. The proof of funds you provide will depend on the source of the funds.

- Loan: Copy of promissory note or statement from entity providing loan.

- Funds/earnings: Three months of statements; if jointly owned, submit a signed letter stating that the other party has no control or ownership of the business.

- Gift: Letter from the donor(s) stating they hold no interest in the business.

- Amount invested and source of funds must be provided for each stockholder with 10% or more holding in the company, sole proprietor, partner, officer, director, trustee, member and/or managing member, as well as any company or trust holding ownership. The proof of funds you provide will depend on the source of the funds.

- Diagram of plant or plan.

- The diagram should denote the bonded premises (area where distilled spirit operations are to be authorized) and general premises. It should also show non-bonded areas and the tasting area to ensure that there is adequate separation between the two.

- The diagram should accurately convey the boundaries and descriptions provided in the distilled spirits plant information section. The diagram should include detailed dimensions and identify major equipment, loading docks, doors, windows, etc.

- The diagram should denote the bonded premises (area where distilled spirit operations are to be authorized) and general premises. It should also show non-bonded areas and the tasting area to ensure that there is adequate separation between the two.

- Organizational documents.

- The organizational documentation required depends on the type of organization. The requirements, listed below, are referenced in 27 CFR §19.677.

- The organizational documentation required depends on the type of organization. The requirements, listed below, are referenced in 27 CFR §19.677.

- Corporate documents.

- The corporate charter or a certificate of corporate existence or incorporation.

- A list of officers and directors with their names and addresses (other than officers and directors who will have no responsibilities in connection with the operation of the DSP).

- A statement showing the number of shares of each class of stock or other basis of ownership (authorized and outstanding), and the voting rights of the respective owners or holders.

- A list of the offices or positions, the incumbents of which are authorized by the articles of incorporation or the board of directors to act on behalf of the proprietor or to sign the proprietor’s name.

- The corporate charter or a certificate of corporate existence or incorporation.

- Limited Liability documents.

- Copy of articles of organization.

- Operating agreement.

- Names and addresses of all members and managers.

- Copy of articles of organization.

- Partnership documents.

- Articles of association or partnership, or certificate of partnership.

- Articles of association or partnership, or certificate of partnership.

- Sole proprietor.

- No documentation required.

- No documentation required.

- Meeting minutes.

- The certified minutes of the board of directors’ meetings, which identify individuals authorized to have signing authority for the company.

- The certified minutes of the board of directors’ meetings, which identify individuals authorized to have signing authority for the company.

- Bond Form (if applicable).

- The Bond Form is TTB F 5110.56 (See Appendix B). Only required if you expect tax liability to exceed $50,000 in a calendar year.

- The Bond Form is TTB F 5110.56 (See Appendix B). Only required if you expect tax liability to exceed $50,000 in a calendar year.

- Signing Authority Form (if applicable).

- The Signing Authority Form is TTB F 5100.1. Only required if you designate an employee to have signing authority or act on behalf of the company.

- The Signing Authority Form is TTB F 5100.1. Only required if you designate an employee to have signing authority or act on behalf of the company.

- Power of Attorney Form (if applicable).

- The Power of Attorney Form is TTB F 5000.8. Only required if you designate a non-employee to have signing authority or act on behalf of the company.

TTB New Distilled Spirit Plant Application Contents

The online TTB new distilled spirits plant application is divided into three main sections:

- Contact and location.

- Application information.

- Business information.

Each section has several subsections. The following describes the items in the application (in the order they appear), and the information you will need to complete each item.

- Contact and location.

- Application contact: Must be registered user of TTB’s online permits system and have signature authority.

- Business headquarters: Legal business name as registered with the IRS; individuals use their given name.

- Address where mail is received for the business.

- Officer/owner information application (see page 4): Officer, owner, member, or partner of the applicant entity; separate application for each person; home address required.

- Application contact: Must be registered user of TTB’s online permits system and have signature authority.

- Business headquarter information.

- Business name, address, phone number, IRS-issued employer identification number.

- Address where approved operation will take place, premises contact name, and premises contact phone number.

- Address where mail is received.

- Business name, address, phone number, IRS-issued employer identification number.

- Application Information Reason for the application.

- For new business: Define type of organization; state in which the business is incorporated; start date (upon TTB approval).

- For change in ownership: Permit number of predecessor; operating permit number; registry number; and name and address of predecessor; define type of organization, date of change.

- For change in general partnership: Permit number of predecessor; operating permit number; registry number and name and address of predecessor; define type of organization, date of change.

- For new business: Define type of organization; state in which the business is incorporated; start date (upon TTB approval).

- Owner background information.

- Has applicant been denied or had a permit revoked or suspended?

- Provide details about felonies: details, dates, places, final disposition.

- Has applicant been denied or had a permit revoked or suspended?

- Officer/ownership information.

- This information must be provided for every stockholder with a holding of 10% or more, sole proprietor, partner, officer, director, trustee, member and/or managing member, as well as for any company or trust holding ownership.

- Name (company name or trust name, if applicable); officer/owner info tracking number, description of duties or relation to proposed operation; percent voting-stock interest, investment in business; name, city and state of your financial institution; source of funds; how source of funds are submitted. Note: for source of funds, provide the following documentation:

- Loan: Copy of promissory note or statement from entity providing loan.

- Funds/earnings: Three months of statements.

- Gift: Letter from donor with name and statement expressing no interest in business).

- Loan: Copy of promissory note or statement from entity providing loan.

- This information must be provided for every stockholder with a holding of 10% or more, sole proprietor, partner, officer, director, trustee, member and/or managing member, as well as for any company or trust holding ownership.

Alternation of Premises

This is defined as multiple operations alternating use of the equipment and premises that is operated by the same person (Example: A bonded wine premises/DSP/ brewery/tax-paid wine bottling house).

Only complete this section of the application if applicable to your proposed operation.

- Required information: Identify the alcohol-related commodity type which you will be alternating.

- Additional information requested: Permit number, registry number, operating number, and application tracking number of identified operation.

Alternation of Proprietors

This describes an arrangement in which two or more people take turns using the physical premises (Example: Rental of space and equipment from a host).

Only complete this section of the application if applicable to your proposed operation.

- Required information: Type of arrangement (tenant, host, or co-tenant), name

- Additional information requested: Permit numbers, registry number, operating permit number.

Signing Authority

This section provides information on each employee who has signing authority or can act on behalf of the company.

If applicable, complete and upload the Signing Authority for Corporate and LLC Officials Form (TTB F 5100.1).

- Required information: Name or title; source of authority; type of authority; if source of authority is from board meeting, then type of board meeting; date of meeting; if limited, in what capacity; effective date of signing authority.

- Additional information requested: Is this person authorized to prepare and review formula submissions and label submissions? Is this person authorized to submit labels and formulas for approval? Does this person have a certificate of label approval (COLA) online or formulas online account? Address, phone number, email.

Power of Attorney Information

This provides information on each non-employee who has signing authority or can act on behalf of the company.

If applicable, complete and upload Power of Attorney Form (TTB F 5000.8). See Appendix D.

- Required information: Name, phone number, address; type of power of attorney; effective date; if limited, specific powers to be conferred.

- Additional information requested: Is this person authorized to prepare and review formula submissions and label submissions? Is this person authorized to submit labels and formulas for approval? Does this person have a COLAs online or formulas online account?

Trade Names/Operating Name

All trade names must be registered with the state of Oregon.

- Required information: Type of trade name/ operating name; name on account, if bottling for someone else; permit number or registry number; letter from owner of trade name expressing permission for you to bottle on their account.

Request for Variance

This request may be filled out to seek legal approval from the TTB to deviate from CFR 27 part 19.

- Required information: Requested variance, alternate method or special permission type, description of request.

Business Information

- DSP operation type.

- Required information: Type of operation, declaration of tax liability exceeding $50,000.

- Required information: Type of operation, declaration of tax liability exceeding $50,000.

- DSP beverage operation information.

- Required information: Type of operation (distiller, warehouseman, processor-rectifier, processor- bottling); total daily output in proof gallons (1 gallon of 50% ethyl alcohol by volume at 60⁰F with ethanol having a specific gravity of 0.7939 at 60⁰F); step-by-step description, starting with raw materials to production gauge (mass flow meter used to measure the amount of alcohol produced for tax and labeling purposes); description of plan to store bulk spirit; total volume that can be stored in wine gallons (231 in3); description of storage for packaged spirits, and whether the spirit will be redistilled.

DSP Information

- Required information: Description of tract of land, using directions and distance; description of bonded premises; description of general premises (e.g., storage of tax paid spirits, offices, lunch rooms, rest rooms, general storage areas) and non-bonded areas. Specify if only a portion of a building is used for plant operations and provide a description; if premises are alternating, provide a description.

- Declare maximum amount of proof gallons produced (stored or in transient bonded premises) during 15-day period; describe physical security at distilled spirits plant including guard personnel and alarm systems; certify locks used meet specifications required in the 27 CFR § 19.192 (f); list people (position and title) responsible for custody and access to keys for lock.

Certified Lock Specifications

27 CFR § 19.192 (f): (i) Corresponding serial number on the lock and on the key, except for master key locking systems; (ii) case-hardened shackle at least ¼ inch in diameter, with heel and toe locking; (iii) body width of at least 2 inches; (iv) captured key feature (key may not be removed while shackle is unlocked); (v) a tumbler with at least 5 pins; and (vi) a lock and key containing no bitting data.

TTB-PROVIDED EXAMPLES OF DESCRIPTIONS

Land Tract Description Example

“From the point of beginning, proceed southwest 43.5 to the northeast corner of the building (Premises #1). From the northeast corner of Premises #1, proceed west 26.5 feet, to the northwest corner of the building. Turn left 90 degrees and proceed south 51 feet to the southwest corner of the building. Turn left 90 degrees and proceed east 12 feet to the southeast corner of the building. Turn right 90 degrees and precede south 5 feet. Turn left and proceed east 14.5 feet to the southeast corner of the building. Turn left 90 degrees and proceed north 51 feet back to the point of beginning.”

Bonded Premises Description Example

“The distillery premises consist of two buildings located within an industrial zoned complex. Starting at business entrance doorway #1, head west 15 feet, then south 15 feet, then east, 15 feet then north 15 feet back to doorway #1. Moving 20 feet south, begin again at business entrance doorway #2, head west 15 feet, then north 18 feet, then east, 15 feet, then south 18 feet back to doorway #2. Both buildings are single level and constructed of wood, concrete block, and stone with a poured concrete floor. The first building is 23 feet x 43 feet. The second building is 22 feet x 42 feet and will be used to store barrels for aging."

Environmental Information

- Required information: Number of employees, address of premises, name of gas and electric company, descriptions of air pollution control equipment, description of solid and liquid wastes produced and means of disposal, operational noise sources.

- Water quality information required information: Operation description; identify and specify time period in which any waste is released into navigable waters; describe means to monitor characteristics of this discharge.

Distilled Spirits Plant Equipment

All stills, tanks, and condensers used in production, storage, and processing of distilled spirits must be listed. All stills must be registered with the TTB in accordance to 27 CFR § 19.79. Stills and equipment listed in this application are considered registered upon application approval.

- Required information: Type of equipment, capacity, type of still, serial number, intended use.

Distilled Spirits Plant Bond

A bond with sufficient coverage is only required if you expect tax liability to exceed $50,000 in a calendar year. Distilled Spirits Bond Form (TTB F 5110.56) must be completed and uploaded into the application if a bond is required.

The operation’s tax liability should be estimated. Tax liability of $50,000 dollars equates to the removal and sale of approximately 1,950 cases of 750 ml bottles of 40% ABV (80 proof) spirit. This was calculated based upon the 26 U.S. Code § 5001 - Imposition, rate, and attachment of tax, which states: “There is hereby imposed on all distilled spirits produced in or imported into the United States a tax at the rate of $13.50 on each proof gallon and a proportionate tax at the like rate on all fractional parts of a proof gallon.”

If withdrawal coverage is required, then a unit bond is needed to cover operations and withdrawals. Refer to 27 CFR § 19.166 (See Appendix F. If tax liability will not exceed $50,000, no bond is required.

If a bond is needed:

- You can provide cash as collateral. All that is needed as documentation is the check number, which can be a personal or cashier’s check or a money order.

- You can purchase a surety bond from a Department of Treasury certified company. Below is the website listing all Department of Treasury certified companies (most common choice): https://www.fiscal.treasury.gov/surety-bonds/circular-570.html.

- A treasury note can be transferred to the TTB, and interest can be collected from the security. The transfer procedure is detailed in the website at: https://www.ttb.gov/main_pages/transferring-securities.shtml.

- Required information: Type of bond, bond kind, effective date of bond, bond category (cash, surety, treasury note), operations coverage, withdrawal coverage, amount of bond, execution date (the date bond was signed).

- Required information for surety bond: Surety name, bond number, surety power of attorney.

- Required information for a treasury note: Committee on Uniform Securities Identification Procedures (CUSIP) number, interest rate, maturity date, issue date.

Related bonds and permits (only fill out this section if applicable to your proposed operation):

- Required information: Commodity type, bond form, bond category, surety name (if applicable).

- Additional requested information: Amount of bond, permit number, registry number.

Transfer in Bond

Only fill out this section if applicable to your proposed operation.

- Required information: Serial number (for example, if transfer record of the facility shipping spirits in bond is completed on January 2014 then the serial number would be written as 2014-1), permit/registry number of shipper, address of shipper, company name of shipper, whether you have maximum bond coverage, amount of coverage, quantity of spirits transferred, name and title of authorized person for receiving plant.

Consent of Surety

This section should not be applicable to new operations.

Only fill out this section if applicable to your proposed operation. A TTB F 5000.18 Consent of Bond (Consent of Surety) must be completed and uploaded if applicable.

- Required information: Form number of the bond you are changing, reason for the consent, dollar amount of the bond that is being changed, the effective date of the change, description of the change.

Statements and Documents

This section of the application provides a list of documents you need to submit based on the contents of your application. It will also specify the correct method for submitting the required information.

Required documentation is uploaded in this portion of the application.

Review and Submit

After the TTB application is complete, you will be asked to review and submit the application. Once submitted, you will be given a permanent tracking number.

The tracking number will end with an “O,” which stands for “Original.” A TTB officer may be in contact with you to ask for clarification or request additional information. Once the application is deemed acceptable, it is forwarded for approval. Once approved, all documentation will be available online.

The approval process time can take over 6 months.

Checklist for completing the Officer/Owner Information Application

❑ Lease agreement or proof of property ownership

❑ State of funding sources

❑ Floor plan

❑ Liquor license application

❑ Business information

❑ Individual history

❑ Limited partnership questionnaire (if applicable)

❑ Limited company questionnaire (if applicable)

❑ Corporation questionnaire (if applicable)

❑ Franchise agreement summary (if applicable)

❑ Distillery Tasting Privilege Application (optional, required for distillery wishes to sell directly to public whether tasting are provided or not)

Required documentation for OLCC

The OLCC application does not have a separate form.

Instead, the application process involves collecting specific information about your operation, completing certain forms, and either mailing or delivering this information to the OLCC office that serves the city or county where your business will be located.

The licensing fee (which is indicated on the application) will be collected after licensing has occurred. Do not send the licensing fee with the application packet.

OLCC office locations can be found at: http://www.oregon.gov/olcc/Pages/OLCC_Offices_ByCounty.aspx.

OLCC Distillery license information can be found at: https://www.oregon.gov/olcc/LIC/pages/distillery_license.aspx.

Lease agreement or proof of property ownership.

You will need to submit a copy of the lease agreement, sales agreement, or other proof of property ownership. It may be a signed or draft document.

Statement of Funding Sources

Each person who invests money in the licensed business must provide a statement of funding sources with the application packet. These individuals must state the total amount of money invested and the origins of the money (which should include the full name of bank, lender, or person from whom they received the money).

Each individual must sign and swear the provided information is accurate.

Floor Plan

The floor plan must be submitted on the OLCC floor plan form. A different form must be used for each floor. The plan must show all areas of your premises and each area must be specified. Location of furniture must be accurately represented.

If you will be providing tastings, the location of the tasting area must be shown; the tasting area must be out of the bonded area.

Liquor License Application

License type (distillery) must be indicated. List all applicants applying for the license, which includes any person or legal entity that may exert control over the business, may incur debt or similar obligations related to the business, may enter the business into contractual obligations, or is the lessee of the property that is to be licensed. Applicant must state if business is already licensed by the OLCC.

The business’s trade name, location, and contact information is required. A contact person for the application must be stated, along with their contact information and address. Each applicant must sign the application to acknowledge that they understand that marijuana is not be sold, given away, or used on the licensed premises.

Business Information

The trade name and business location must be indicated. The operation’s hours, type of entertainment, hours during which music will occur (live or with a deejay), and each section’s seating count must also be provided.

Individual History

OLCC Individual History Form must be completed by all individuals or entities listed on the liquor license application. If the business is a corporation, then any person with responsibility over operation of business (president, vice president, treasurer, etc.), director with 3% or more voting stock, person with 10% or more issued stock has to complete an Individual History Form.

If the business is an LLC, then managing members and any member who owns 10% or more of the company has to complete an Individual History Form.

Provide your full name, social security number, date of birth, phone number, driver license information, address, name of spouse or domestic partner and whether your spouse or domestic partner will be involved with the business. Other items related to your history are: any driving convictions related to driving without a license or insurance within the last.

10 years, conviction of any felony within the last 10 years, participation in drug or alcohol diversion programs in lieu of conviction, possession of a liquor or recreational marijuana license within Oregon or another state, and liquor licensing history (including if the license was denied or cancelled). In addition, you need to specify if you are applying for a full on-premises, limited on-premises, off-premises, or brewery-public house license.

Information regarding the ownership status of all applicants in businesses that manufacture, wholesale, or distribute alcohol in the United States; ownership of other full on-premises, limited on-premises, off- premises, or brewery-public house licenses must all be provided.

Limited Partnership Questionnaire (if applicable)

The partnership must be approved by the Oregon Secretary of State to conduct business in Oregon. You have to provide the partnership name, year filed, and business location. You also need to provide a list of all partners and type of partnership (general or limited), percentage of ownership, who the server education designee is, and their date of birth.

If a general partner is a legal entity, a flowchart should be included to demonstrate the legal entity relationship.

A general partner must sign the forms.

Limited Liability Company Questionnaire (if applicable)

The Limited Liability Company (LLC) must be approved by the Oregon Secretary of State to conduct business in Oregon. The information required includes LLC name and year filed, business trade name and location, list of all members and percentage of membership interest, officers (individually listed on a separate paper), and the name of server education designee and their date of birth.

If a member is another legal entity who controls 10% or more of membership, a separate questionnaire must be filled out (LLC or corporate). A managing member must sign the forms.

Corporation questionnaire (if applicable)

The corporation must be approved by the Oregon Secretary of State to conduct business in Oregon.

Required information includes corporation name and year of incorporation, trade name and location of business, list and title of all corporate officers, list of board of directors, list of stockholders and number of shares held, number of stocks issued and unissued, amount of shares authorized to be issued, and the name of server education designee and their date of birth.

A corporate officer must sign the form.

Franchise Agreement Summary (if applicable)

The information required includes applicant name (which is the person or legal entity listed on the liquor license application form), business’s trade name and location, franchisor name, a list of all franchisees (all people or companies which will operate the business), expenses related to the franchise (including inventory cost, initial fees, and royalty fees), loan agreement of franchisor (if applicable), and rental/leasing agreement of franchisor (if applicable).

A copy of the franchise agreement or letter of intent is also required.

Distillery Tasting Privilege Application (optional)

If the owners of a distillery wish to provide tasting and/or sell factory sealed containers directly to the public, they must be approved by the OLCC. Once a distillery is approved to provide tastings by the OLCC, the owners may contact the OLCC Retail Service Division at 503-872-5020 or via email at OLCC.RetailServices@state.or.us to seek approval to sell factory-sealed containers directly to consumers at the licensed distillery premises.

The information required on the Distillery Tasting Privilege Application includes licensee name and trade name, address of licensed premises, address of other premises where tastings will be provided (up to 5 other premises), and means to distinguish the tastings provided to trade visitors versus the tastings provided to the public.

Also required is a floor plan form for Oregon distillery tasting privilege for each location providing tastings (which includes licensee name, trade name, and business address) and a sketch that includes all rooms that make up the distillery licensed premises and labeled, identified tasting areas.

Review and Submit

Once completed, mail or deliver the OLCC application packet to the OLCC office that covers the city or county where the business is intended to be located. Do not send the licensing fee with the initial application; this fee will be collected at a later date. An OLCC employee will contact you about the license fee and will give you documentation to take to the local government for review and recommendations.

Local governments will generally not review your application until it is approved by the OLCC.

ADDITIONAL DSP PROCESSOR REQUIREMENTS

Once the federal permit, Oregon license, and local approval is obtained, you can begin spirit production and start the label and formula approval process, which is outlined in Appendix F.

After obtaining a federal certificate of label approval (COLA) and a formula approval (if necessary) has been obtained, you can begin the process of getting approval to sell by the bottle in Oregon. This process is briefly outlined in Appendix G along with a link to an OLCC guide that describes the privileges and requirements for Oregon distillery licensee.

Information in this guide was sourced from the TTB website, OLCC website, and 27 CFR part 19.

APPENDICES

The following forms and definitions are provided for reference. Because this information can change, be sure to check the TTB and OLCC websites for the most updated resources before applying for your distilled spirits plant license.

Appendix A: Employer Identification Number SS-4

Appendix B: Distilled Spirits Bond Form TTB F 5110.56

Appendix C: Signing Authority for Corporate and LLC Officials TTB F 5100.1

Appendix D: Power of Attorney TTB F 5000.8

Appendix E: Definitions from 27 CFR § 19.1

Appendix F: Bond Requirements from 27 CFR 19.166

Appendix G: Labeling and formula information

DISTILLERY STARTUP WORKSHOP FROM OSU

In the expert-led workshop, you will:

- Learn essential information on relevant practical aspects of making a new spirit and finishing the product.

- Interact with practical demonstrations of distillation.

- Address the challenge of adjusting alcohol content to legal requirements.